This week we’re going to look in detail at business sector saving, going through a set of business accounts to identify what constitutes business saving. BUT DON’T STOP READING…

This is going to be a very detailed look at an extremely specific concept, in sharp contrast to the broad overview of financial markets in the last few weeks, or the monetary system in the previous section of the blog. In effect, I am getting the scalpel out and dissecting a small, essential, yet often neglected component of our economy. What is happening in financial markets is being driven by this one element, and if you don’t understand it you won’t be able to understand the significance of these dynamics. This will be long and detailed, because sometimes the acquisition of knowledge is worth a little effort.

I’m going to do this by going through a set of business accounts, based on examples used in “An Introduction To National Income Accounting” by David King (1984). This is a very old book – I bought it just because it was cheap second-hand but it turned out to be extremely clear. The purpose of the accounts here is specifically to show the link to national income accounting, not to be a guide on business accounting. So far as I’m aware (I’m not an accountant) a company would not normally produce an appropriation account, and what is is shown here on a capital account would normally be reflected on the balance sheet. However, setting the accounts out in this manner enables us to identify clearly what we’re looking for – business saving, and how that might then be used. I don’t know if that’s why King used this approach this, or simply whether accounting conventions have changed in the last 34 years, but I haven’t been able to find a more recent guide that sets this out as clearly, so I can’t give a more up-to-date or authoritative reference.

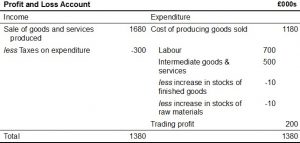

What matters is that this way of thinking through the finances of a business helps us identify exactly what we’re looking for. So let’s start. Below is an example of a firm’s profit and loss accounts.

The left-hand column is income, and this is straightforward – it shows the income from the firm selling its goods less taxes on expenditure. The right hand-column is expenditure, and starts off straightforwardly enough, with the salary expenses and the costs of buying supplies off other firms. But it also has two entries for increases in inventory (finished and unfinished goods), and this is the first thing to note. A profit and loss account shows the profit made on goods produced and sold in that financial year. If, as in this case, the firm has increased its inventory, the cost of producing the unsold goods is subtracted from its in-year total costs.

Similarly, if the firm’s inventory had reduced this would indicate that the firm had sold more than it produced that year. The cost of using up this inventory would be added to the firm’s expenditure, as if the firm had bought its inventory off itself. Again, this ensures that the profit recorded is based on activity in that financial year.

The outright purchase of fixed capital (the other component of investment) is not shown on the profit and loss account, but normally the depreciation of fixed capital is recorded as an expense. If a machine costing £20,000 is expected to last 20 years, then a depreciation cost of £1,000 is shown in each year of the life of the asset, reducing the trading profit. But because these accounts are being used in an example relevant to the calculation of gross domestic product depreciation is not shown, and I will say more about this later.

Finally, you’ll notice that the profit is recorded as an expense. This sometimes confuses people – surely profit is a good thing, why is it shown as a cost? This is partly an accounting convention, to ensure that balances sheets always balance. But there is a logic to this – the business’s primary purpose is to make profits for its owners, so if you assume that profits are going to be paid to the owners then the profit will be a cost for the firm. In fact, the use of profits is more subtle than that, which is the whole point of this post. (Economists also get confused by this idea that profit is a cost. They do also think of profit as a cost – as the “opportunity cost” of what could have been earned if funds had been invested in alternative enterprises. But I’ve read textbooks that make a big deal of this, claiming that economists are seeing profits differently. It’s as if they were unaware that profits are routinely shown as an expense on a set of accounts!)

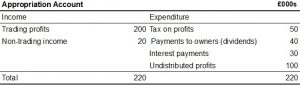

From the profit and loss accounts we move to the appropriation accounts, which basically shows how profits will be distributed. So the “expense” of profit on the profit and loss account becomes an “income” on the appropriation accounts. Added to this is non-trading income, such as interest earned on bank deposits or returns on other financial investments.

The expenses on the appropriation account are the different ways that profits are used. First of all profit is taxed (sometimes businesses are very keen to show profits in order to encourage investors, but at others they are keen to account in a way that shows less profit so that they pay less tax); interest payments are made; and then profit is distributed to shareholders through dividends.

But some profit is also retained – “undistributed profits”. This is business saving – this is what we’re interested in.

Remember that saving is defined as disposable income minus consumption expenditure. All income is either profits or wages, and national income is the sum of all wages and profits. So undistributed profits are a form of income. But firms don’t have final consumption expenditure – they only purchase intermediate goods and services that are then used in further production – so this undistributed profit is business sector saving. The System of National Accounts 2008 states (paragraph 9.11, page 179):

“…the saving of corporations is often described as the ‘retained earnings’ or ‘undistributed incomes’ of corporations.”

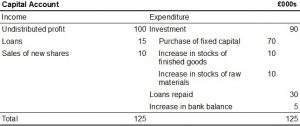

We’ve worked meticulously through the accounts to dissect exactly what constitutes business saving. Now we want to look at how this saving might be used. So now the “expense” of undistributed profit on the appropriation account becomes the income for the capital account:

All investment expenditure (in the economic sense) is shown on the capital account. So we see an entry for purchase of fixed capital, and we also see an entry for increase in inventory that exactly matches the negative expense shown on the profit and loss account. If inventory had reduced in that year (i.e. revenue had been earned by selling and not replacing inventory) the reduction would be shown as an expense on the profit and loss account and a negative expense on the capital account, representing the reduction in the assets of the firm.

Other capital expenses are loans repaid, purchase of financial assets (e.g. buying shares in other companies) and the increase in the firm’s bank balance (which is in itself a form of financial asset). In essence, once all income and expenditure transactions have been completed across all three accounts, what is left at the foot of the accounts making it all balance is the increase or decrease in the firm’s bank balance.

Once we start looking at financial markets you will not believe how important this change in bank balance, along with the purchase of financial assets, proves to be.

We’ve delicately removed all the layers in our accounting dissection, to reveal this “residue” at the end of the process of business. I will be referring you back to this in 3 weeks time. (And remember that holding money in a bank account or buying a short-term bond are just different ways of storing wealth without tying it up long-term – they are both forms of liquid financial asset.)

Also shown on the income side of the capital account are loans taken out and new shares sold. Sale of other assets such as corporate bonds would also be shown here. In fact, taking out a bank loan can be seen as “selling” a financial asset (the debt to the bank being that asset) – or on the other side of the coin, selling a bond is just another way for the firm to borrow money. If we anticipate that finance raised through borrowing or sale of financial assets is going to be used on investment expenditure then there is a natural logic in showing this as income on the capital account, balancing the expenditure shown in the right hand column.

What you can see from all this is that investment expenditure by firms naturally comes out of their undistributed profits. I have seen introductory courses and textbooks on GDP make the assumption that “all profit returns to household” – in other words, that firms do not retain profits and rather pay them all out as dividends. This gives you one less thing to think about on an introductory course, but the implication is that all investment is funded by borrowing. And of course, they will subsequently assume that the reason saving equals investment is because banks lend people’s savings to firms for investment (please don’t make me explain again why this is completely wrong – please tell me you’ve got that by now).

The reality is that firms are more likely to rely on their retained earnings to pay for fixed capital, and use borrowing to fund inventory and other working capital. In his outstanding “A History of Money” (pages 286-92 ) Glyn Davies describes how in the industrial revolution firms mainly paid for investment out of retained earnings, while borrowing from banks to fund working capital (raw materials, wages, extension of credit to buyers etc). (Note that this lending would have increased the money supply, essential alongside rising productivity.) In “The Bankers’ New Clothes” (page 173) Anat Admati and Martin Hellwig cite the research showing that in the modern economy firms typically use retained earnings for investment. Similarly, Wynne Godley and Marc Lavoie use the assumption that retained earnings fund fixed capital and borrowing funds inventory as the basis for their models in “Monetary Economics”, with a very interesting discussion on the logic of this (pages 47-51) which unfortunately is too much to include here.

This doesn’t mean that firms don’t ever borrow for fixed capital expenditure, but to make this assumption for the purposes of a model is a better approximation than the implicit assumption in mainstream macro that firms do fund fixed capital through borrowing.

What this reveals is that the most important and simple way that saving is intermediated to investment is undistributed profits (i.e. business saving) being spent on fixed capital. This is the essential concept that these accounts convey, and hopefully it is worth the effort!

We can understand this more fully by coming back to the concept of depreciation. As noted, firms will normally depreciate the cost of an asset over its life by recording an expenditure on the profit and loss account. Because the firm does not actually pay out any money that corresponds to that expense, this “fake” expenditure will be reflected in an increased bank balance on the capital account (and hence there will be a corresponding entry for depreciation as income on the capital account). You could think of it as depreciation being the mechanism by which a firm is saving towards the replacement of its asset in the future. Although I doubt reality is ever nearly that neat, if this did happen it means that business saving is clearly the way that existing assets are replaced, and new funding would only be needed for upgrading fixed capital or for new innovations.

This is the difference between gross and net domestic product (NDP). NDP does not include expenditure on replacement of existing assets, whereas GDP does. This expenditure does not increase the wealth of a nation as a whole, it merely sustains it at its previous level. However, such expenditure increases GDP (but not NDP), making it appear that this expenditure is increasing the national wealth. Hence GDP can and does hide inadequate expenditure on investment to maintain the wealth of the nation

NDP would in fact be a much better measure of economies than GDP, but it relies on calculations of depreciation used by companies all over the world. These are inconsistent and unreliable and hence GDP is used instead. The System of National Accounts is very clear about this (paragraphs 2.141-2, page 34):

“In principle, the concept of value added should exclude the allowance for consumption of fixed capital. The latter, in effect, is not newly created value, but a reduction in the value of previously created fixed assets when they are used up in the production process. Thus, theoretically, value added is a net concept.

“However, gross measures of product and income are commonly used for various reasons. The depreciation of fixed assets as calculated in business accounting does not generally meet the requirements of the SNA… Not all countries make such calculations, and when they do there may be differences in methodology (with some of them using business data even when inadequate). Consequently, gross figures … are generally considered more comparable between countries. So GDP is broadly used even if it is, on a conceptual basis, economically inferior to NDP.”

I could have clarified this point about the difference between gross and net domestic product back when I first explained GDP, but I wanted to save it till now because because it highlights the vital importance of maintaining the fundamental value of fixed capital. What we are seeing here is that by spreading the cost of fixed capital over the life of the asset, a business can automatically save towards its replacement cost – and investment expenditure to replace existing fixed capital will naturally come from business saving. In such a scenario, the intermediation of saving to investment does not take place through financial markets at all, but simply through firms retaining earnings and spending this business saving on investment.

But when we start looking at financial markets we will see how business saving is actually being used, and we will see just how badly this system is going wrong!